8 Minute Market Structure Series

One topic, no prep calls, just 8 minutes of concise, expert insight for better markets.

Episode 007 | VIRGINIE O’SHEA

In episode seven Richard Johnson speaks with Virginie O'Shea, CEO of Firebrand Research where we discuss the plumbing of the industry.

Watch this episode to hear Virginie discuss the example of T2 Securities in Europe that was setup by the European Central Bank because the CSDs weren't collaborating:

"It’s about being more open to collaboration and less competitive. A lot of issues around post trade infrastructure are that interoperability is not there, we have challenges because of proprietary standards… that cause nightmares for operations teams.” - Virginie O’Shea

Episode 006 | kevin mcPARTLAND

In episode six Richard Johnson speaks with Kevin McPartland, Head of Market Structure Research for Greenwich Coalition.

Watch this episode to hear Kevin’s idea that could be “the best of both worlds between and RFQ where you have that bilateral understanding, and an order book where it is anonymous":

“I think one of the most important things would be to create a trading mechanism that allows the counter-parties to know each other, but still do that in an electronic way.” - Kevin McPartland

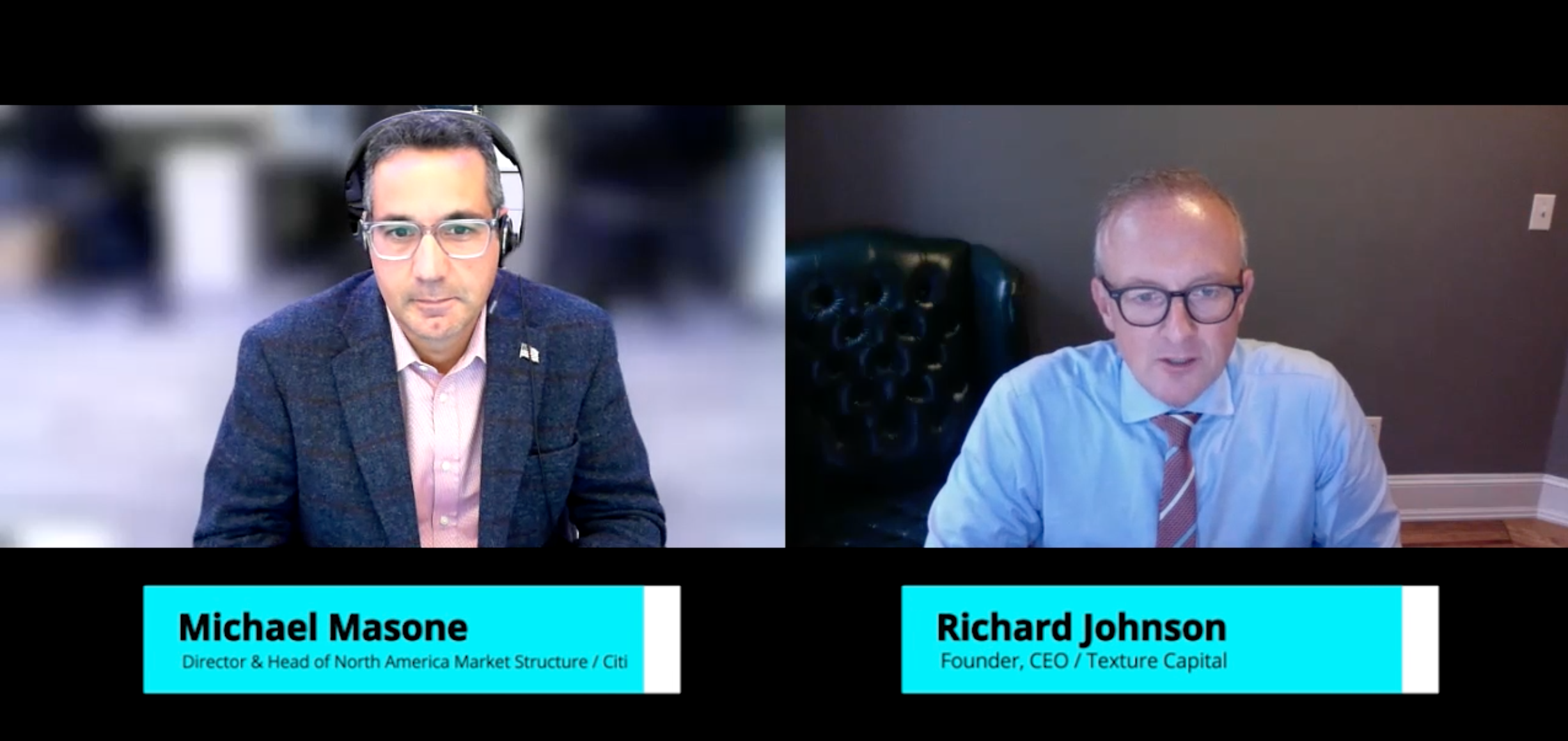

Episode 005 | Mike masone

In episode five Richard Johnson speaks with Mike Masone, Head of North American market structure for Citi.

Here's a preview:

“Where are the inefficiencies in today’s markets? One that is getting a ton of attention now is the scrutiny of how retail order flow is executed by a handful of market makers who pay for that order flow, and there are actual or perceived conflicts around that… what I think would really improve that overall is to allow for exchanges to quote in sub-pennies” - Mike Masone

Episode 004 | VLAD KHANDROS

In episode four Richard Johnson speaks with Vlad Khandros, Head of Corporate Development at Trumid.

Here's a preview:

"To try to dictate that everyone use a single, specific way, is not the right way to go about it. ... Whether it's building out about a product, or thinking about policy changes, flexibility is actually key." - Vlad Khandros

Episode 003 | Bill Harts

In episode three Richard Johnson speaks with Bill Harts, Board Member, ACTIV Financial, and former CEO, Modern Markets Initiative.

Here's a preview:

"Institutional investors are increasingly unwilling to display their orders, knowing that they may not interact with this retail order flow, and that leads to fragmentation and other unwanted side effects… I would implement a "simple" change: Require off-exchange market makers to check the price on a non-affiliated market center before trading as principal. In that way, both retail and institutional investors get the best price.". - Bill Harts

Episode 002 | Dave Cushing

In episode two Richard Johnson speaks with Dave Cushing, former Director of Trading at Wellington.

Here's a preview:

“The idea of a market being a fundamentally auction driven marketplace… that concept we really, sorely need to reintroduce to markets, and that becomes especially true for less liquid assets.”

“The thought process around trying to move away from the… one size fits all model has become more important”. - Dave Cushing, Co-Founder, Senior Advisor at Pine Grove Capital

Episode 001 | Dave Lauer

In the very first episode of 8 Minute Market structure we speak with industry expert Dave Lauer to get his take on the most important market structure issues.

Here's a preview of Dave's interview:

“What are the principles of market structure that we’re looking for? We’re looking for transparency; we’re looking to minimize complexity; we’re looking for smart, adaptive regulations; [we're looking for] open competition for order flow; and we’re looking to avoid inefficient economics through subsidization.” -Dave Lauer, CEO at Urvin AI